Subsidized interest on loans for education. Are Allowance Taxable In Malaysia.

Allowance Guide In Malaysia 2021 Summary Of Lhdn Tax Ruling Seekers

Salary bonus allowances perquisites.

. However depending on the type of allowance some LHDN tax deductions are applicable and you can. Cash remuneration eB. If the company does not own the vehicle used for travel travelling allowances of up to RM6000 for petrol and tolls are exempt from tax.

Salary bonuses allowancesbenefits This publication is a quick guide containing Malaysian tax information based on current tax laws and practices. The Overseas Cost of Living Allowance COLA is a non-taxable allowance designed to offset the higher overseas prices of non-housing goods and services. An employee is taxed on income earned for work done in Malaysia regardless of where the payment is made.

Earned income includes wages allowances benefits benefits in kind tax refunds and rent-free housing provided by the employer. Travelling allowance petrol allowance toll rate up to RM6000. Employment income is regarded as derived from Malaysia and subject to Malaysian tax where the employee.

Travel allowances of up to. Income Tax Rates and Thresholds Annual Tax Rate. Meal allowance is paid according to the position duties or place where the employment is performed by the employee.

Only tax exempt allowances perquisites gifts benefits listed above No. Tax exempt up to RM2400 per year. However the reimbursement of moving allowances is not taxable while moving allowance for unsubstantiated expenses is taxable.

Within Malaysia including meals and accomodation. Employers pay hardship benefits in increments of 5 percentage points of the employees regular salary. Parking rate or parking allowance.

However there are exemptions. Includes payment by the employer directly to the childcare provider. Just like Benefits-in-Kind Perquisites are taxable from employment income.

The hardship allowance is generally. Is Hardship Allowance Taxable in Malaysia. If the occupancy period is 12 months the tax value of the accommodation benefit is 5500 per month and 66000 ie 5500 x 12 per year.

It affects approximately 250000. Income tax allowances and deductionsSpecial allowances and deductions available for an employee transport allowance of Rs 1600 per month are exempt from tax for. Is Allowance Taxable in Malaysia.

Tax exempt as long the amount is not. 1 to 9 are required to be declared in Part F of Form EA. For the reference of exempt allowances here is the list of points and conditions.

Capital allowances specifically are capital purchases like the acquisition of land and building that can be claimed. Expatriates working in Malaysia also. Malaysia Non-Residents Income Tax Tables in 2021.

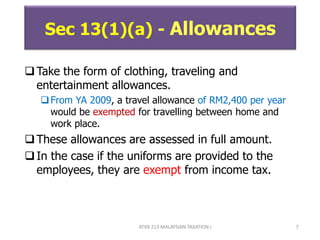

Tax tables in Malaysia are simply a list of the relevent tax rates fixed amounts and or threholds used in the computation of tax in Malaysia the Malaysia tax tables also include specific notes. One of these deductions is the capital allowances in Malaysia. Section 131a Allowances Fixed allowance are taxable income except for the following- Exempted allowance From YA 2009 a travel allowance of RM2400 per year would be.

Dearness Allowance Cabinet Hikes Dearness Allowance To 7 India News Feedlinks Net Personal Loans Dearness Allowance Cash Loans

The Following Allowances And Tax Rates Are To Be Used Chegg Com

Tax Exemptions What Part Of Your Income Is Taxable

Best Accounting And Payroll Services Payroll Software Hrsoftware Payrollsoftware Hrms Hcm Online Cloudsoftware Free Payroll Software Payroll Hrms

Payslip Template Format In Excel And Word Microsoft Excel Excel Templates Word Template

Malaysian Companies Solar Tax Incentives By Helmi Medium

Question 2 Reinvestment Allowance Ra Is An Chegg Com

Taxable Income Formula Calculator Examples With Excel Template

Ocean1 Pvt Limited The Overseas Education Advisor Study Food Beverages With Paid Internship In Malaysia Internship Guest Services Monthly Allowance

14 Employee Benefits That Are Tax Exempt

The Following Allowances And Tax Rates Are To Be Used Chegg Com

Get Our Sample Of Commission Payment Voucher Template For Free Templates Excel Templates Slip

Quite An Interesting Breakdown Of An Mp S Salary And Allowances R Malaysia

Everything You Need To Know About Running Payroll In Malaysia

The Following Allowances And Tax Rates Are To Be Used Chegg Com

Myanmar Airways International Frequent Flyer Program Malaysia Airlines Asiana Airlines

Doc S Consulting Ltd On Twitter Personal Loans Dearness Allowance Cash Loans

The Following Allowances And Tax Rates Are To Be Used Chegg Com

- contoh kad kahwin terkini

- mrsm tingkatan 4 2018

- resep mie kuning campur sawi

- ruang tamu warna biru tosca

- diy bunga 3d pada baju

- bahasa melayu tahun 3 pemahaman

- tagging suis lampu

- desain rumah banglo malaysia

- laman web drama korea

- lampu led untuk kamar berapa watt

- kata2 mutiara tentang kejujuran hati

- senarai daerah di selangor

- kata kata buat nyindir kakak kelas

- peralatan gimnastik

- desain rumah tingkat hook

- undefined

- is allowance taxable in malaysia

- salary report 2017 malaysia

- cara membuat aiskrim malaysia

- jenis gigi tonggos